In the present time, renting a property in India is difficult, whether it is for business or residential purposes. The challenge lies in when the two involved parties do not come to a common conclusion. These challenges could be anything, like control of rent, evictions by landlords, breaches in terms of rented premises by landlords or tenants, and more. Hence, a mutual agreement known as a rent agreement comes into force.

In order to address these issues, this blog offers comprehensive information on rent agreements in India, including their definitions, requirements, legal enforceability, online registration, and payment of stamp duty/e-stamp in India.

Process to Create a Rent Agreement in India:

- Finalizing the terms of the rent agreement.

- Drafting the Rent Agreement.

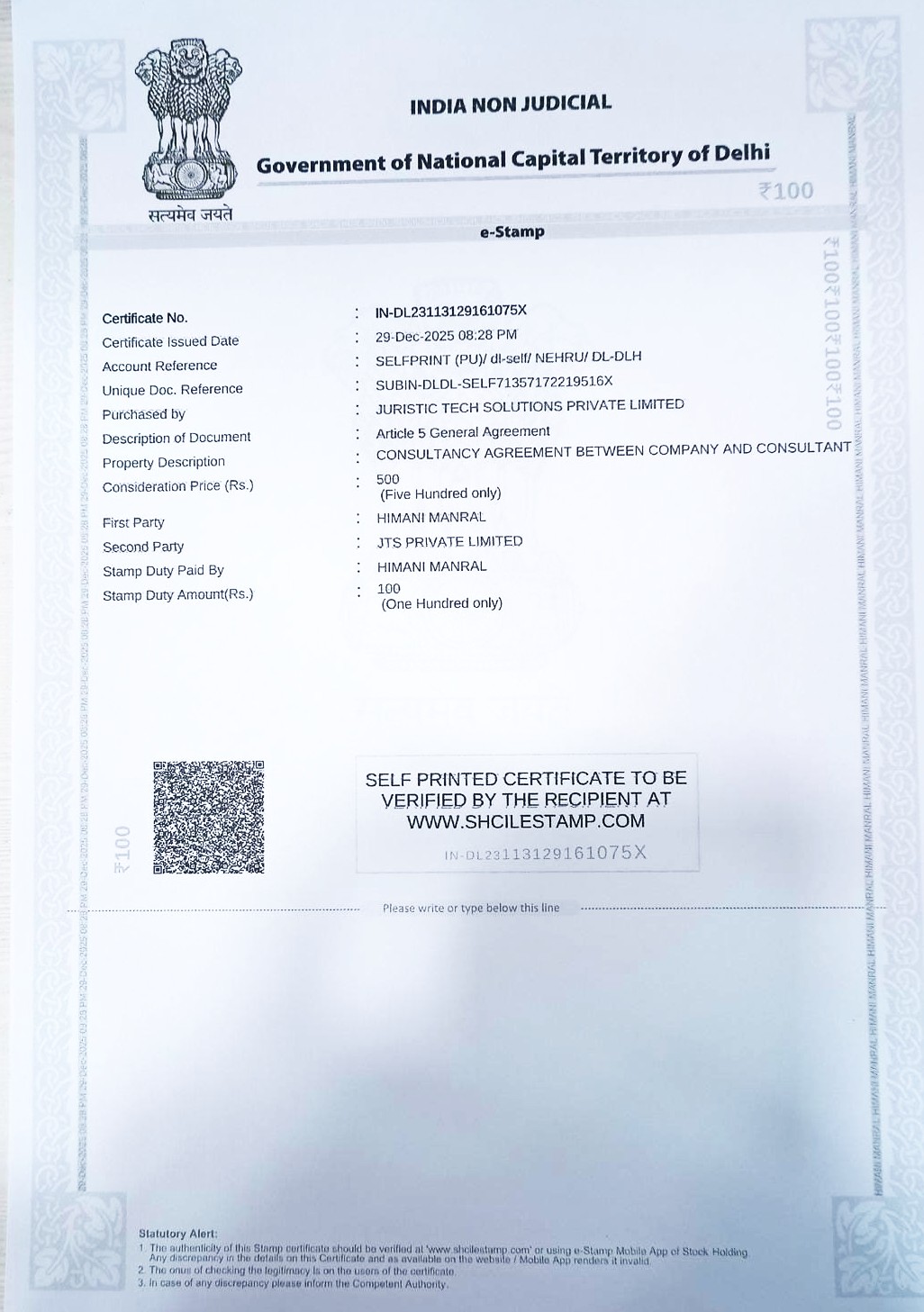

- Pay the required stamp duty offline or online as per the requirement.

- Print the agreement and then proceed with the signatures of both parties and the respective witnesses as required.

- Register at the sub-registrar’s office if the agreement stands for more than 11 months.

Drafting a Rent Agreement

- Details of Parties: Names, addresses, and other required details of the landlord and tenant as per their eligibility under state-specific rent laws.

- Description of Rented Property and Its Use: The agreement should describe the rented property, i.e., the complete address, rooms, amenities/facilities provided, and the purpose of the rent, whether for residential or commercial. Also, you cannot use it for illegal purposes.

- Rent, Maintenance Charges, Rent Revision, and Payment Terms: The agreement should mention mutually agreed rent, maintenance charges, revised rent, due date for every month, and mode of transaction (i.e., cash, bank transfer, or other modes).

- Security Deposit: The rent agreement may contain the deposit amount and its return date, along with any deductions for damages or other reasons.

- Duration: Clearly specify the duration of the agreement between the two parties.

- Penalty: The agreement should also include a penalty and additional charges to be borne by the tenant in case of delayed rent payments.

- Rights and Obligations: One must state the rights and duties of both parties for rented premises.

- Maintenance & Utilities: The agreement should also mention Responsibilities for maintenance, basic amenities, and utilities as provided by the landlord for rented premises and the respective charges.

- Restriction and Prohibition Clause: Outline all the restrictions and prohibitions for the tenant, like sublet conditions, usage restrictions, etc.

- Termination Clause: Mention the notice period and exit procedure.

- Renewal Clause: Terms for extension and renewal of agreement.

- Jurisdiction: Because rental laws vary by state, specify the state where the property is located. Alternatively, outline a suitable solution based on that state’s rental laws to resolve any disagreements between the involved parties.

- Additional Clauses: Specify any additional clauses, if any.

How can we register a Rent Agreement?

- Draft a rent agreement using all the required details.

- Calculation and payment of the stamp duty

Each state determines its own stamp duty, so users can access a state-specific registration portal or e-stamp portal to calculate the stamp duty, and the payment is made accordingly.

General Formula for Stamp Duty = (Monthly Rent × Lease Term in Months) + (Security Deposit) × Stamp Duty Rate

- Registration of Agreement

Visit the Sub-Registrar Office (SRO) with the landlord, tenant, and 2 witnesses. Take the required documents like ID/address proof, photographs, stamp duty receipt, and printed agreement. Pay the registration charges (varies from state to state). After submission and approval, collect the registered copy.

Important Points:

- While rent agreements for up to 11 months typically don’t require registration in most states, stamp duty is still mandatory. Without proper stamping, the agreement will be inadmissible as evidence in court should a dispute arise.

- If the agreement is for 12 months or more, then registration is compulsory under the law (Registration Act, 1908).

- Online registration is only available in a few states, like Maharashtra and Karnataka.

- Since stamp duty rates and rules differ in each state, always check the official state website before proceeding.

Which Law Governs Rental Agreements in India?

When it comes to renting property in India, many people are confused about whether a Rent Control Act applies or whether the Transfer of Property Act (TPA) governs their agreement. The answer depends on which state you are in, the rent amount, and the type of property.

State Rent Control Acts

- Every state has its own Rent Control Act (e.g., Karnataka Rent Act, 1999; Maharashtra Rent Control Act, 1999; Delhi Rent Control Act, 1958).

- These acts generally act

- Regulate standard rent and prevent excessive increases.

- Fix limits on security deposits.

- Protect tenants from unjust eviction.

- Applicability is usually restricted to lower-rent premises, older buildings, or specific notified areas.

Many newer or higher-rent properties are exempted from Rent Control Acts.

Transfer of Property Act, 1882 (TPA)

- Where a property does not fall under the local Rent Control Act, tenancy is governed by the TPA and the Indian Contract Act, 1872.

- Key provisions under the TPA (Sections 105–117):

- Leases can be created orally or in writing (though written agreements are always safer).

- Leases exceeding 11 months must be registered under the Registration Act, 1908.

The terms of the agreement primarily establish the rights and responsibilities of the landlord and the renter.

Practical Rule of Thumb

- If the premises fall within the Rent Control Act (based on rent amount, location, type of property, and exemptions), the state Rent Act applies.

If not, the tenancy is governed by the Transfer of Property Act, 1882.

Why This Matters

- Under Rent Acts → tenants have stronger statutory protection (e.g., eviction only on specific grounds, rent control, security deposit limits).

Under TPA → tenancy is contract–driven; the landlord and tenant enjoy more freedom to decide terms, but eviction and disputes are decided strictly by the agreement and TPA.

Rental agreements in India are governed either by the relevant State Rent Control Act (if applicable) or, in all other cases, by the Transfer of Property Act, 1882.

Always check:

- The state law,

- The rent amount and type of premises, and

Whether any exemptions apply.

Additional Information:

What is a Rent Agreement?

A rental agreement is a legally enforceable document that spells out the rules and conditions for renting a home, firm, or other space. Both parties, i.e., the landlord and the tenant, sign the agreement. It outlines the length of the lease, the rent amount, rent revisions, the security deposit, limitations, eviction grounds, and the rights and responsibilities of both the landlord and the tenant, among other important provisions.

Why Is a Rent Agreement Important for Landlords and Tenants?

A well-written rental agreement is essential whether you’re a renter moving into a new residence or a landlord renting out your property. By outlining the duties and obligations of each party, it lowers the likelihood of future conflicts.

Types of Rent:

Key Difference between- Leave and License, Rent and Lease

Comparison Table: Leave & License vs. Rent vs. Lease Agreements

| S.No. | Comparison | Leave and License | Rent Agreement | Lease Agreement |

| 1 | Type of Right | Permission to use the property | Right to occupy the property | Transfer of interest for fixed term |

| 2 | Legal Statute | Indian Easements Act, 1882 | Differ state to state (refer to Rent Control Acts) | Transfer of Property Act 1882 + Registration Act 1908 |

| 3 | Duration | Short term (less than or equal to 11 months) | Less than or equal to 11 months | Long-term (12 months or more) |

| 4 | Stamp duty | Lower (state to state differ) | Depends from state to state | Higher (based on lease value) |

| 5 | Registration Requirement | Optional but recommended in many states | Optional (if ≤ 11 months)Mandatory if >11 months | Mandatory if term is 12 months or more |

| 6 | Common in | Metro cities (like Mumbai, Pune, Bangalore, etc.) | Across India | Commercial and industrial space |

Legal Status of Rent Agreement in India: Understanding the term “Premises”

For rental arrangements across India, state-specific Rent Control Acts apply to the legal enforceability and rights of both landlord and tenant. These Acts regulate various aspects of tenancy. They include the amount of rent and the duration of the tenancy. Also, they outline the eviction process and specify the termination procedures. They define the type of property covered, legally referred to as “premises.”

Let us understand what the word “premises” means under rent control laws and how its definition differs across states like Rajasthan, Delhi, Maharashtra, Uttar Pradesh, Karnataka, and Tamil Nadu.

What Does “Premises” Mean Under Rent Control Laws?

The legal definition of “premises” is much more detailed, but the main idea of “premises” remains similar across India—relating to rented land or buildings, but the scope and exclusions differ from state to state. The term “premises” plays a crucial role in determining whether a rent agreement falls under the ambit of a state’s Rent Control Act.

In general, “premises,” under the various states’ Rent Control Acts, typically refers to

Any land that is not used for agricultural purposes or any building or part of a building (excluding farm buildings) that is rented or intended to be rented for residential purposes, commercial purposes, or any lawful use. It also generally includes

- Gardens, godowns, garages, and out-houses attached to the property

- Furniture and fixtures provided by the landlord

- Fittings and amenities necessary for comfortable use

- Land appurtenant to the rented building

But excludes rooms in hotels, inns, dharmshalas, lodges, boarding houses, or hostels

Unless the rent agreement does not explicitly states that the rooftop or terrace is part of the rented premises.

The exact definition and scope of “premises” under rent control laws vary from state to state.

Some key states have interpreted the term in various ways.

- Maharashtra—The Maharashtra Rent Control Act, 1999, covers residential, commercial, and storage premises and specifically excludes hotels, hostels, and public authority-owned properties.

- Delhi – Rent agreement Delhi – Delhi Rent Control Act, 1958. Similar broad definition of “premises,” but applies only to properties with rent less than ₹3,500/month and excludes religious trusts and hospitality establishments, and premises belonging to the government.

- Uttar Pradesh—Urban Buildings (Regulation of Letting Rent and Eviction) Act 1972 governed rental properties in urban areas. The Uttar Pradesh Regulation of Urban Premises Tenancy Act 2021 replaced the UP Rent Control Act. The act regulates both residential and non-residential buildings. Exempted premises include rural and village properties, government buildings, institutional staff housing, religious or charitable trust properties, and any others specifically notified by the state.

- Rajasthan—The Rajasthan Rent Control Act, 2001, covers both residential and commercial premises but excludes public buildings and properties managed by religious or charitable trusts.

- Karnataka—The Karnataka Rent Act, 1999, includes both residential and commercial properties and their associated facilities and excludes hostels, educational institutions, and hotels.

Understanding this definition helps landlords and tenants to draft valid and enforceable rent agreements and, in long parlance, to avoid disputes over possession, eviction, or maintenance responsibilities. Therefore, it is essential to have in-depth knowledge of the specific rent control legislation applicable in your state so as to ensure you check for all legal compliances in your rent or lease agreement.

What is rent agreement registration?

One can officially register a rent agreement at the local Sub-Registrar Office (SRO). This makes the agreement legally valid and acceptable in court. The SRO collects the registration fee as part of the process under the Registration Act 1908.

Why should you register your rent agreement?

- Legal Validity and Enforceability: You must register your rent or lease agreement if it lasts more than 11 months under Indian law. A registered agreement ensures that the landlord and tenant record the terms with the government. Without registration, the agreement has no legal value in court. Only registered documents are strong evidence and are admissible in court.

- Protect Rights: Whether you’re renting out your property or living on rent, a registered rent agreement is a must. It allows you to protect the rights of both the landlord and tenant. Like taking legal action for eviction, unpaid rent, deposit refund, or any other tenant-related issue. Dispute settlement.

- Prevent Exploitation: Registered agreements provide clarity over terms and conditions and cannot be tampered with, which safeguards both parties to the agreement.

What is the stamp duty on a rent agreement in India?

Stamp duty is a levy levied by the state government on property-related papers.The amount of stamp duty is set by state-specific laws, notices, and official portals.

Are stamp duty and registration fees required for rental agreements in India?

For rent agreements longer than 11 months, the majority of states mandate both stamp duty and registration. To prevent future disputes, both must be provided by the parties.

For more information, one can refer to some official state government websites below:

| Sl. No. | State/UT | Online e-Stamp duty/Registration portal | Website |

| 1 | Delhi | Registration & Stamps Department | https://srams.delhi.gov.in |

| 2 | Uttar Pradesh | Stamp and Registration Department | https://igrsup.gov.in |

| 3 | Maharashtra | Department of Registration & Stamps | https://igrmaharashtra.gov.in |

| 4 | Karnataka | Kaveri Online Services (KAVERI 2.0) | https://kaverionline.karnataka.gov.in |

| 5 | Gujarat | GARVI – Registration Department | https://garvi.gujarat.gov.in |

| 6 | Rajasthan | eGRAS Rajasthan | https://egras.raj.nic.in |

| 7 | Tamil Nadu | TN Registration Department | https://tnreginet.gov.in |

| 8 | Haryana | Jamabandi Haryana | https://jamabandi.nic.in |

For payment of stamp duty:

Purchase stamp paper from local stamp dealers or use e-stamping, which is offered in certain states via the SHCIL (Stock Holding Corporation of India Ltd.) portal or national e-stamping service portals: https://www.shcilestamp.com

Where Is e-Stamping Available in India?

As of 20th March 2025, the e-Stamping system is active in the following states and union territories: Andaman & Nicobar, Andhra Pradesh, Arunachal Pradesh, Assam, Chandigarh, Chhattisgarh, Dadra & Nagar Haveli and Daman & Diu, Goa, Gujarat, Himachal Pradesh, Jammu & Kashmir, Jharkhand, Karnataka, Ladakh, Meghalaya, Manipur, Delhi, Odisha, Puducherry, Punjab, Rajasthan, Tamil Nadu, Tripura, Uttar Pradesh, and Uttarakhand.

Where Can You Make Online Payments and Print e-Stamp Certificates?

Citizens can pay online and directly print their e-Stamp certificates in these states/UTs: Delhi, Karnataka, Himachal Pradesh, Ladakh, Chandigarh, Jammu & Kashmir, Puducherry, Andaman & Nicobar, Uttar Pradesh, Assam, Punjab, Manipur, Uttarakhand, Meghalaya, and Arunachal Pradesh. This facility is available as per the approval of each respective state or union territory.

Frequently Asked Questions (FAQs)

- Do you need to register a rental agreement in India?

Yes, registration is mandatory for rent agreements of 12 months or more. - Why should I register my rent agreement?

Registration gives legal validity and protects the rights of the landlord and the tenant. - Can I make a rent agreement for 12 months?

Yes, you must register it at the local sub-registrar’s office. - What is stamp duty on rent agreements?

The state government charges stamp duty as a fee to legalize rent documents. - How do we calculate stamp duty on rent?

- Stamp Duty = (Monthly Rent × Lease Term) + (Deposit × Stamp Duty Rate)

- Is it compulsory to pay both stamp duty and registration charges?

Yes, the parties must include both for rent agreements over 11 months to be legally valid. - What is e-stamping for rent agreements?

E-stamping is the online method of paying stamp duty securely and legally. - Where can I get e-stamping done in India?

E-Stamping is available in states like Delhi, Maharashtra, Karnataka, UP, etc. - How can I pay stamp duty online for a rent agreement?

You can pay via SHCIL’s official portal, www.shcilestamp.com, or state e-portals. - Is online registration of rent agreements available?

Yes, some states like Maharashtra and Karnataka offer full online rent agreement registration. - Is notarization the same as registration?

- No, notarization only verifies signatures, while registration gives legal enforceability.

- What is the difference between Leave & License and Lease?

Leave & License gives permission to use the property; Lease transfers legal possession. - What documents do you need to register a rent agreement?

Along with the rent agreement, landlord and tenant ID proof, address proof, photos, and two witnesses. - Do the Rent Control Acts cover all rented properties?

No, the regulations exclude some like hostels, government buildings, and religious properties. - What happens if you do not register a rent agreement?

It has no legal standing, and legal proceedings cannot use it. - What is the usual duration of a rent agreement in India?

- Most are for 11 months to avoid mandatory registration, but longer terms are legal if registered.